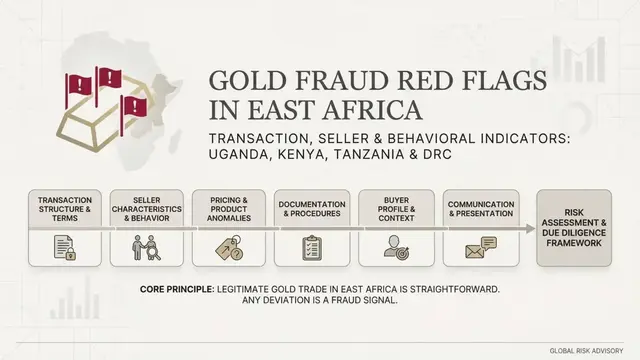

- Indicators of Gold Fraud in East Africa: 🚩🚩🚩 Focus on Uganda, Kenya, Tanzania & the Democratic Republic of the Congo (DRC) 🚩🚩🚩

- Decoding "Gold in Transit": 🚩 A Common Gold Scam Indicator

- Deciphering Gold CIF Offers: 🚩 A Red Flag for Potential Scams

- Indications of a Gold Scam: 🚩 Beware When You Don't Understand Incoterms

- Understanding the Warning Signs: 🚩 Advance Fees for Attorneys as a Gold Scam Indicator

- Understanding the Deception: 🚩 The Promise of Gold Bars and a Woman

- The Curious Case of Gold Inspections: 🚩 A Red Flag for Scams

- Scam Indicator: 🚩 When a supposed gold seller quotes prices

- Recognizing Gold Scams: 🚩 The Dangers of Attractively Priced Gold

- Understanding the Warning Signs: 🚩 When Gold Sellers' Passports Don't Match the Country of Gold

- Recognizing Gold Scams: 🚩 The Dangers of Seeking High Profits as a Foreigner in East Africa

- Indications of a Gold Scam: 🚩 Beware of Dealing with Gold Transactions from Hotels

- Understanding the Warning Signs: 🚩 When Gold Sellers Lack Physical Office Space or Licenses

- Indications of a Gold Scam: 🚩 Beware When Gold Sellers Avoid Licensed Dealer Offices

- How Mention of Specific Selling Procedures Can Signal a Scam

- Indications of a Gold Scam: 🚩 Beware When Gold Sellers Show Passports or Other Documents

- Indications of a Gold Scam: 🚩 Beware When Gold Sellers Begin Discussing Papers

- Using incorrect terms like "Aurum Utalium" 🚩

- The scam with Certificate of Ownership 🚩

- The Truth About Lack of Documentation: 🚩 Identifying Scam Risks in Gold Transactions

- Gold Sellers Who Claim Inheritance: 🚩 A Common Indicator of a Gold Scam

- Identifying Gold Scams: 🚩 The Girlfriend's Gold Story Trap Explained

- How the Term "Cash and Carry" Can Signal a Scam 🚩

- Indications of a Gold Scam: 🚩 Beware When Gold Sellers Ask Which Refinery to Bring the Gold To

- Recognizing Gold Scams: 🚩 The Dangers of Asking for Documents and Nationality

- Indications of a Gold Scam: 🚩 Beware When Gold Sellers Don't Ask Your Price

- Indications of a Gold Scam: 🚩 Beware of Sellers Showing Pictures of Other Buyers Holding Gold

- How Photos of Gold with Your Name Can Signal a Scam

- Indications of a Gold Scam: 🚩 Beware When You Haven't Determined Your Own Price

- How Offers of Large Quantities Can Signal a Scam

- Indications of a Gold Scam: 🚩 Beware When Gold Sellers Lack a Physical Office

- How an Empty Office Can Signal a Scam

- Indications of a Gold Scam: 🚩 Beware When Gold Nuggets Look Uniform and Button-Like

- Indications of a Gold Scam: 🚩 Beware of Gold "Powder" Offerings

- How Excessive Shine Can Signal a Scam

- Indications of a Gold Scam: 🚩 Beware When the Gold Surface Doesn't Match Real Melted Gold Texture

- Recognizing Gold Scams: 🚩 The Dangers of Oversized "Gold" Bars

- Recognizing Gold Scams: 🚩 The Dangers of Bad-Tasting "Gold"

- Indications of a Gold Scam: 🚩 Beware When Generals Are Involved

- Recognizing Gold Scams: 🚩 The Dangers of Name-Dropping in Gold Transactions

- Indications of a Gold Scam: 🚩 Beware When Diplomats, Politicians, and the United Nations Are Involved

- Deciphering the Red Flags: 🚩 Gold Sellers Mentioning Security Houses

- The Truth About Export Taxes: 🚩 Identifying Scam Risks in Gold Transactions

- Indications of a Gold Scam: 🚩 Beware When Gold Sellers Have No Money but Demand Your Payment for Fees

- Understanding the Warning Signs: 🚩 Unsolicited Gold Offers via Email

- Indications of a Gold Scam: 🚩 Beware When a Full Corporate Offer (FCO) Is Involved

- Indications of a Gold Scam: 🚩 Beware When You Have No Experience in Gold Trading

- Understanding the Warning Signs: 🚩 Lack of Business Administration Skills

- Understanding the Warning Signs: 🚩 Newcomers Seeking Quick Profits from Gold

- Indications of a Gold Scam: 🚩 Beware When You Don't Have Enough Money to Buy Even One Gram of Gold

- Understanding the Warning Signs: 🚩 Discrepancies Between Phone Numbers and Seller Names

- Understanding the Warning Signs: 🚩 Discrepancies Across Multiple Contact Numbers

- Indications of a Gold Scam: 🚩 Beware When Beautiful Women Are Involved as Brokers

- Indications of a Gold Scam: 🚩 Beware When Gold Sellers Ask How Many Kilograms You Want to Buy

- How the Presence of Fake Watches and Gold Jewelry Can Signal a Scam

- Indications of a Gold Scam: 🚩 Beware When You Have Never Seen Natural Gold Before

- Indications of a Gold Scam: 🚩 Beware When You Don't Run a Business with Staff

- The Truth About Internet Search Skills: 🚩 Identifying Scam Risks for Novice Gold Buyers

- Indications of a Gold Scam: 🚩 Beware When You Don't Use Your Own Attorney or Have Any at All

- You Are a Victim If You Don’t Ask Your Embassy About Potential Gold Dealing 🚩

- Related pages

Indicators of Gold Fraud in East Africa: 🚩🚩🚩 Focus on Uganda, Kenya, Tanzania & the Democratic Republic of the Congo (DRC) 🚩🚩🚩

This article outlines numerous red flags indicating potential gold fraud in East Africa, particularly in Uganda, Kenya, Tanzania, and the DRC. Key scam indicators include offers of “ gold in transit,” misapplied CIF terms, requests for advance fees, unverified sellers lacking physical offices, and deals involving suspiciously low prices or large quantities. Other warning signs include sellers using fake documentation, name-dropping high-profile figures, or insisting on unusual procedures. The article emphasizes the importance of due diligence, legal consultation, and embassy verification to avoid falling victim to scams, urging buyers to prioritize transparency, proper licensing, and verified transactions when dealing in gold.

Download the PDF presentation:

Decoding “Gold in Transit”: 🚩 A Common Gold Scam Indicator

The concept of purchasing gold while it’s still en route—often referred to as buying “gold in transit”—is a prevalent red flag for potential fraud within the East African region. Legally, this practice is not feasible due to several logistical and regulatory constraints inherent in international trade laws governing precious metals like gold.

Firstly, when dealing with tangible assets such as physical bullion or coins of gold, ownership transfer typically occurs upon delivery at an agreed-upon location where both parties can verify the authenticity and quality. This process ensures that buyers receive exactly what they have paid for without any discrepancies in weight or purity—a critical factor given the high value associated with these transactions.

Moreover, international trade regulations require clear documentation such as bills of lading to confirm shipment details before ownership is transferred from seller to buyer. These documents serve not only as proof of dispatch but also guarantee that goods are shipped under agreed terms and conditions. Buying gold in transit circumvents this crucial verification step because the transaction occurs while the asset remains unverified by an independent third party, leaving buyers vulnerable.

The inability for a purchaser to inspect or verify their purchase until after delivery is complete makes buying “gold in transit” inherently risky and often indicative of fraudulent activity. Scammersexploit these vulnerabilities by promising high returns on gold that may not exist at all; they might use fictitious shipping documents or simply pocket the money without dispatching any goods, leaving buyers with no recourse for recovery.

In summary, purchasing “gold in transit” is a significant indicator of potential scams due to its deviation from standard legal and logistical practices. The absence of immediate verification opportunities coupled with reliance on unverified documentation makes it an attractive yet perilous proposition that savvy investors should avoid at all costs.

Deciphering Gold CIF Offers: 🚩 A Red Flag for Potential Scams

In the context of gold trading in East Africa—specifically Uganda, Kenya, Tanzania, and the Democratic Republic of Congo (DRC)—the term “CIF” or Cost Insurance Freight is often used to describe shipping terms. According to INCOTERMS 2020 definitions by the International Chamber of Commerce (ICC), CIF pertains exclusively to sea freight; it includes costs for transporting goods via ocean vessels, along with insurance and port charges up until delivery at a destination port. However, in East Africa’s gold trade context where shipments are predominantly conducted through air transport due to logistical constraints or urgency demands—CIF becomes misleading when applied incorrectly.

The misapplication of CIF terms can serve as an indicator for potential fraud within the region’s gold market. Unscrupulous sellers may exploit this misunderstanding by offering “gold CIF” deals, suggesting that all costs up until delivery are covered under a single price point similar to sea freight transactions. However, since air transport is not encompassed in traditional CIF terms and often incurs higher expenses than ocean shipping due to its speedier nature and additional handling requirements at airports rather than ports, the cost structure becomes opaque for buyers unfamiliar with these nuances.

Consequently, only gullible or uninformed buyers may fall into this trap. They might assume that a “CIF” offer includes all necessary costs associated with air freight when it does not explicitly cover them under standard CIF terms. This discrepancy can lead to unexpected additional charges upon delivery and potential disputes over the actual cost of goods received, making due diligence crucial for any buyer engaging in gold transactions within East Africa using such shipping terminology.

Indications of a Gold Scam: 🚩 Beware When You Don’t Understand Incoterms

Incoterms (International Commercial Terms) are standardized rules established by the International Chamber of Commerce to simplify and clarify international trade transactions. These terms define the responsibilities, costs, risks, and obligations between buyers and sellers for goods in transit. Each term specifies who is responsible for tasks such as loading or unloading cargoes from ships at ports; paying freight charges (the cost associated with transporting a shipment); obtaining insurance coverage on shipments while they are en route to their destination country etc.. For instance, under the CIF (“Cost Insurance and Freight”) Incoterms rule, the seller is responsible for delivering goods onboard a vessel in an agreed port of export. The seller must also arrange and pay for freight costs up until the designated port of import as well as purchase cargo insurance to cover potential risks during transit.

Gold is almost never transported by ship!

I have facilitated numerous international gold exports between countries without ever utilizing the “Cost Insurance and Freight” (CIF) Incoterm. This is due to my exclusive use of secure land or air transportation methods that negate the need for maritime shipping.

Buyers who ask for CIF terms likely do not have a competent business administrator; they want someone else to handle all risks and responsibilities by saying, “Bring me the goods, then I will pay.” However, insisting on CIF terms can make buyers appear inexperienced or uninformed.

Potential sellers of gold who say, “We will export gold on CIF basis,” are only profiling buyers as potential victims and finding those inexperienced or lacking a business administrator who will start believing that some gold will be shipped to them without paying first for it—until they find there is an “advanced fee” which is part of the scam.

Understanding the Warning Signs: 🚩 Advance Fees for Attorneys as a Gold Scam Indicator

Oh joy! The ‘seller’ just informed me there’s an unexpected delay due to some mysterious legal hiccup, and they’ve kindly referred me to their supposedly top-notch attorney who conveniently can’t be found on any bar association records. But don’t worry, folks—all I need is a few more advance fees (because apparently the scam isn’t rich enough yet), and soon my gold bricks will magically appear right after I pay just one…more…tiny fee!

Understanding the Deception: 🚩 The Promise of Gold Bars and a Woman

Oh boy, here’s a delightful little dance called “The Nigerian Gold Jig”! Imagine this: you’re chatting with what seems like your dream woman (or maybe just some kids and their uncle having a laugh), who insists on playing house online. She’s not just any old girl next door; no, she’s an American soldier stationed in—wait for it—a tropical paradise called Nigeria or Ghana! And to prove her authenticity, she sends you pictures that are basically the military equivalent of those “Hot Celebrities Who Look Like Your Grandma” memes. Spoiler alert: they’re either stolen from porn stars' Instagram pages or lifted straight off Google Images.

Now comes the fun part—she wants you to pretend like y'all are married, and she’s your loving wife (or husband… who knows?). Then out of nowhere, bam! She drops a bombshell about an inheritance involving gold. You’re thinking: “Jackpot!” But oh no, little do you know that this isn’t the pot at the end of some rainbow; it’s more like falling down Alice’s rabbit hole into Scamdoria.

So off you go on your merry way trying to gather money for shipping fees or bribes (because heaven forbid anyone should get in between a scammer and their ill-gotten gains). You fork over cash, thinking “This is the big one!” But surprise! Instead of gold bars raining down from the sky like some kind of shady treasure shower, you end up with an empty wallet. And just when you thought it couldn’t get any better—you realize that not only did she rob your bank account but also made a fool out of you in front… well maybe nobody because who would believe this?

And there we have it: the grand finale to our hilarious little scam opera, where “she” (or they) ride off into the sunset with all your hard-earned cash. You’re left standing alone on stage holding an empty bag and a heart full of regrets—what a showstopper!

The Curious Case of Gold Inspections: 🚩 A Red Flag for Scams

Imagine walking into a currency exchange office, where you swap your hard-earned US dollars for euros. You expect that place to be licensed, legitimate—and certainly not in someone’s backyard or the backseat of their car.

Now picture this: Someone wants to sell gold and invites strangers over just so they can inspect it at some mysterious location? That is like asking a banker who has never seen you before come visit your house because there might be something valuable hidden under that old couch. In reality, when dealing with precious metals or large sums of money, the process should resemble going to an established exchange office—professional and transparent.

This scenario becomes even more ludicrous in Africa’s gold markets where buyers have their own offices for a reason: sellers who want cash need to bring it directly there because that is how business works. It’s not like buying vegetables from your local farmer, after all; you don’t expect them to haul everything over just so you can pick through the produce at home.

So if someone suggests meeting somewhere else instead of their office or yours—run! This isn’t some friendly neighborhood barter session where trust is built on a handshake and good intentions. Inspecting gold should always happen in your own space, ensuring that every ounce meets expectations before any money changes hands—and keeping scammers at bay while you’re at it.

And let’s not forget the mobile buyers who roam from village to village—yes those individuals exist but they aren’t usually dealing with large-scale transactions or inviting strangers into their operations. They are more like gold prospectors, moving around and buying small quantities here and there without needing fancy inspections every step of way. In conclusion: Inspecting the Gold should be done at your own place where you can ensure that everything is legit before making any payments.

So next time someone invites inspect some shiny yellow stuff in an unfamiliar location—think twice. It might just save both your money and sanity!

Scam Indicator: 🚩 When a supposed gold seller quotes prices

In virtually every corner of the globe, it is gold buyers—the professionals with offices and all that jazz—that establish their own pricing structures. These buyers set daily rates or publish them as percentages based on London market prices or global benchmarks.

Sure there are exceptions where deals can be negotiated like a fancy dinner at an expensive restaurant but in the real world of Africa’s gold trade, legitimate buyers fix their prices. Ask any seasoned buyer what their price is and you’ll find that seller comes to them because they agree with this set rate—it’s competitive or simply good enough.

Now imagine someone claiming “the seller’s setting the price!” Oh please. In every gold mining country around Africa, it is always buyers who are calling the shots on prices. Why would a seller undercut themselves when buyers already have higher rates? It’s like expecting your local baker to sell bread cheaper than you can buy flour—it just doesn’t add up.

This sort of talk about sellers setting lowball prices should raise eyebrows and trigger alarm bells louder than an old-fashioned fire drill in school. If it sounds too good to be true, chances are high that the gold deal is a scam waiting to happen

Recognizing Gold Scams: 🚩 The Dangers of Attractively Priced Gold

In any reasonable market scenario where sellers are genuine business people trying to make a profit off of the goods they offer for sale, buyers would dictate prices. However this is never what happens with gold mining operations in countries that have active mines.

When you see “gold” being offered at suspiciously low rates—like US $30,000 when it should be priced around US $60,000/kg or even lower than market price—it’s a clear indicator of trouble. These so-called sellers are not legitimate gold dealers; they’re scammers preying on the unsuspecting and naive.

Imagine this: If genuine buyers were setting prices, would any seller ever offer “gold” at an absurdly low rate? Of course not! In regions like East Africa, West Africa, Asia—Thailand in particular—and even more surprisingly Germany or Netherlands. Even some parts of USA are known for these shady practices.

Real gold dealers follow certain principles and protocols to ensure they’re getting the real deal; hence avoiding being scammed by such fraudulent tactics.

Professional buyers know this well enough not fall into traps set up with bait prices, when it should be higher. This article is aimed at those who often find themselves duped.

So if you see gold or any precious metal priced too good to be true—it probably isn’t real and the sellers are most likely scammers trying to lure in gullible buyers into their web of deceitful documentary and advance fee schemes.

Understanding the Warning Signs: 🚩 When Gold Sellers' Passports Don’t Match the Country of Gold

In the unlikely event that you find yourself in a foreign country, supposedly there for gold purchasing purposes, but end up with nothing more than a photocopy of someone else’s passport from yet another nation—consider it your first red flag.

Why not pause and ask some pertinent questions? Like why this individual is operating in a country they aren’t even citizens of. Or perhaps inquire about their choice to peddle gold abroad instead of within the borders that supposedly issued them documentation. But no, let’s just skip all logical inquiry because common sense isn’t exactly high on our list today.

The truth often lies beneath these layers of confusion: many scammers are part of an international network spread across multiple countries. They might as well be playing a game of passport roulette—Kenyan to Uganda one day, Tanzanian to Kenya the next—and they’ll happily flash you any document that suits their narrative for your fake gold transaction. If this doesn’t scream “scam” from every angle, then what does?

Recognizing Gold Scams: 🚩 The Dangers of Seeking High Profits as a Foreigner in East Africa

In the heart of East Africa lies an alluring trap: cheap gold. It’s like finding a pot of glittering treasure at the end of your dusty path. You whip out that old calculator gathering dust in your bag—perhaps it’s even one with those tiny buttons and blinking screen—and start crunching numbers.

Suddenly, you’re seeing dollar signs dancing before your eyes: “Wow,” you think to yourself, “if I could just get my hands on this gold! Imagine the piles of cash!” Before long, thoughts turn into schemes. You find yourself contemplating selling off everything from family heirlooms and homes to borrowing money left right and center.

But here’s where reality bites harder than a mosquito in an African jungle: if you’re chasing high profits as a foreigner in East Africa—and especially when it sounds too good—you’re likely walking straight into the jaws of scam artists. The allure is strong, but so are its consequences. You might find yourself back home with nothing more than empty pockets and shattered dreams.

So here’s your friendly warning: if you’re tempted to pack up everything for a gold rush in Africa, think twice—or maybe thrice—before taking the plunge into this glittering abyss of deceit!

Indications of a Gold Scam: 🚩 Beware of Dealing with Gold Transactions from Hotels

In the realm of shady deals and dubious characters, there’s a peculiar trend emerging: buyers checking into high-end hotels to conduct business with so-called “gold sellers.” These aren’t just any meetings; they’re invitations extended directly to your private residence, or worse, luring you into their web. Picture this—scammers who will stop at nothing to kidnap, blackmail and dig up every last detail about your family. They don’t even need a physical office—they’re operating right out of luxury hotel suites.

These gold sellers are promising mountains of the precious metal—a whopping 50 kilos, or maybe even tonnes—but they can’t bother to secure an actual workplace. Isn’t that just delightful? They lure you in with promises of unimaginable wealth, but when it comes time to meet face-to-face, they’re nowhere but a plush hotel room.

Here’s the kicker: if someone asks where your “office” is and it turns out to be some swanky suite, that should set off alarm bells. These aren’t legitimate business people; they’ve got networks of criminals at their disposal.

They could very well spy on you from within those luxurious walls, waiting for the perfect moment to strike.

So here’s a word of advice: don’t deal in hotels unless it’s your own vacation and not some gold seller. The next time someone invites you to discuss business over room service, politely decline. Save yourself the headache—and possibly even worse—by steering clear of these hotel-based scams.

Understanding the Warning Signs: 🚩 When Gold Sellers Lack Physical Office Space or Licenses

In navigating the treacherous waters of gold investment, one quickly encounters a glaring issue: legitimate businesses typically require an actual physical space to operate from—you know, like offices and such fancy things! But when you inquire about this so-called “gold seller’s” office location? Cue crickets. They’re as evasive as a politician dodging tough questions on election day.

If they finally relent and reveal their supposed headquarters, be prepared for the grand tour of… absolutely nothing. It might look impressive at first glance, but don’t let your guard down just yet! This place could very well have been rented out for mere hours to give off an air of legitimacy. So go ahead—knock on doors, ask around. Find that local chairperson and grill them: “How long has this company actually been here?” Verify everything from the lease agreement’s duration to whether they’ve even bothered stocking up on paper clips or coffee in their break room.

And speaking of empty offices, some of these so-called businesses are operating with a skeleton crew—or worse. Picture walking into an office where not a single soul is present; no papers strewn about desks (because who needs paperwork when you’re running a scam?), and certainly no water dispenser or snacks to make your visit more comfortable. It’s like they’ve set the stage for their grand performance, but forgot all the props! If it looks too good to be true—it probably is—and in this case, if an office seems suspiciously deserted… well then you’re likely staring right at a scam.

Indications of a Gold Scam: 🚩 Beware When Gold Sellers Avoid Licensed Dealer Offices

Imagine walking into a currency exchange office, where you swap your hard-earned US dollars for euros. You expect that place to be licensed, legitimate—and certainly not in someone’s backyard or the backseat of their car.

Now picture this: Someone wants to sell gold and invites strangers over just so they can inspect it at some mysterious location? That is like asking a banker who has never seen you before come visit your house because there might be something valuable hidden under that old couch. In reality, when dealing with precious metals or large sums of money, the process should resemble going to an established exchange office—professional and transparent.

This scenario becomes even more ludicrous in Africa’s gold markets where buyers have their own offices for a reason: sellers who want cash need to bring it directly there because that is how business works. It’s not like buying vegetables from your local farmer, after all; you don’t expect them to haul everything over just so you can pick through the produce at home.

So if someone suggests meeting somewhere else instead of their office or yours—run! This isn’t some friendly neighborhood barter session where trust is built on a handshake and good intentions. Inspecting gold should always happen in your own space, ensuring that every ounce meets expectations before any money changes hands—and keeping scammers at bay while you’re at it.

And let’s not forget the mobile buyers who roam from village to village—yes those individuals exist but they aren’t usually dealing with large-scale transactions or inviting strangers into their operations. They are more like gold prospectors, moving around and buying small quantities here and there without needing fancy inspections every step of way. In conclusion: Inspecting the Gold should be done at your own place where you can ensure that everything is legit before making any payments.

So next time someone invites inspect some shiny yellow stuff in an unfamiliar location—think twice. It might just save both your money and sanity!

How Mention of Specific Selling Procedures Can Signal a Scam

When individuals claim to sell gold but emphasize specific “procedures,” it serves as a red flag that could indicate fraudulent activity. While government regulations do mandate certain documentation practices from buyers of gold, in actuality, these entities often bypass rigorous verification with sellers due to practical limitations—they rarely question the legitimacy of the gold provided.

The typical transaction flow is straightforward: 🚩 sellers bring their gold for melting, receive cash on the spot, and promptly leave. It’s uncommon for a seller to request formal documentation like receipts unless they operate a larger-scale business which necessitates such records.

However, in legitimate transactions involving gold sales or purchases, terms like “procedures” are seldom mentioned. This term is predominantly used by scammers who prey upon individuals who tend to trust official-sounding processes and documents. The mention of procedures often targets people from countries where such formalities hold significant weight, making the potential victim more susceptible.

Scammers exploit this tendency by engaging in a step-by-step escalation once they detect any interest or questioning about “procedures.” They understand that anyone showing concern over these terms is likely to be more trusting and thus easier to deceive.

In stark contrast, genuine gold trading practices in regions like East Africa are far simpler. The only consistent procedure involves the straightforward exchange of gold for cash: deliver the gold, receive money immediately. In such markets, discussions about “procedures” are virtually non-existent since transactions rely on trust and direct exchanges rather than bureaucratic formalities.

In summary, an emphasis on “procedures” when dealing with supposed sellers of gold should be seen as a warning sign. Genuine transactions in this sector are usually characterized by simplicity and transparency, without the need for complex protocols or documentation beyond basic verification steps.

Indications of a Gold Scam: 🚩 Beware When Gold Sellers Show Passports or Other Documents

When so-called sellers of gold start mentioning peculiar procedures, like casually slipping you their passport copy, it should wave agigantic red flag—it’s almost certainly a scam.

In the vibrant gold markets of Uganda, Tanzania, and Kenya, individuals don’t flash their passports or IDs as proof; nope! Their most convincing ID is the actual gold they’ve ingeniously concealed in places like socks, underwear pockets—hidden treasures that speak volumes more than any official document.

Imagine receiving a passport from someone halfway across an African nation. It’s almost laughable how transparently they’re playing into the naive foreigner stereotype, hoping you’ll fall for their scam hook, line, and sinker because “Oh sure! Of course I’ll trust your shiny new passport!”

And let’s not even delve into whether that passport is real or forged—it’s utterly irrelevant. The crux of the matter is this: if they genuinely had gold on hand, why would they jump through such bizarre hoops? They could easily turn their supposed treasure into cold hard cash within their own borders.

The true motive behind sending you a passport? Pure manipulation—an attempt to weave an illusion of trust around your unsuspecting heart so that you become the next victim in their elaborate deceitful scheme.

So, remember: when gold sellers start pulling passports out of thin air, it’s time to walk away—swiftly and without hesitation!

Indications of a Gold Scam: 🚩 Beware When Gold Sellers Begin Discussing Papers

When engaging with so-called “sellers” of gold, be wary if they bring up the topic of documents excessively or claim not to have them at all. This is a red flag for several reasons:

Irrelevance in Transactions: In genuine gold transactions, especially in regions like East Africa, buyers are primarily interested in verifying the authenticity and quality of the gold itself rather than getting lost in paperwork.

Profiling Victims: By bringing up documents or their absence, these sellers aim to gauge your interest and gullibility. If you start engaging with them on this topic, they see it as a green light to continue their scam.

Diverting Attention: Talking about documents is often just a distraction tactic meant to shift the focus away from the actual gold transaction towards bureaucratic formalities that are rarely demanded in such transactions.

Skepticism of Legitimacy: In legitimate deals, sellers would prioritize showcasing and selling their gold rather than getting caught up in discussions about documentation. The mention or avoidance of documents is a suspicious behavior indicative of potential fraud.

In essence, when dealing with gold purchases, keep your wits about you and remember: real transactions are straightforward—gold shown upfront without unnecessary complications involving “documents.” If someone starts weaving that narrative into their pitch, it’s time to walk away.

Using incorrect terms like “Aurum Utalium” 🚩

Companies claiming vast gold reserves while using inaccurate or fabricated terms such as “Aurum Utalium”—a non-standard, misleading Latin phrase—are strong indicators of potential fraud. The correct chemical and historical term for gold is simply aurum (from the Latin “aurus”, meaning “shining”), with no recognized variant like “Utalium.” Such deliberate misuse or invention of terminology suggests a lack of scientific rigor, an attempt to obscure transparency, or outright deception about their actual holdings. Reputable entities in metallurgy and finance adhere strictly to established nomenclature; deviations from this norm should raise immediate skepticism regarding the legitimacy of claims involving precious metals like gold.

The scam with Certificate of Ownership 🚩

The practice involving the use and circulation of Certificates of Ownership in gold transactions often points to potential scams. These documents are typically counterfeit or fabricated because their primary purpose has been superseded by more concrete proof mechanisms like agreements, contracts, purchase receipts, and ownership transfers documented through legitimate channels. In reality, genuine trade operations rely on verifiable documentation such as export licenses and compliance with international regulations rather than relying heavily—or solely—on Certificates of Ownership that can be easily falsified.

When individuals or entities begin circulating these certificates without proper verification from recognized authorities (like customs agencies), it raises red flags indicating an attempt at deception. Such behavior is indicative not only of dishonesty but also suggests attempts to bypass legitimate processes required for international trade compliance, including export controls and anti-money laundering regulations which mandate thorough documentation checks beyond mere origin claims made via such certificates.

The Truth About Lack of Documentation: 🚩 Identifying Scam Risks in Gold Transactions

When individuals claiming to sell gold start discussing unusual documentation procedures, this can be a red flag indicating potential fraud. In legitimate transactions involving gold in East African countries, while governmental documentation is indeed necessary by law, the process of acquiring such documents is typically handled efficiently and internally by established entities within the industry—specifically between buyers of gold and their respective tax offices.

It’s important to understand that sellers are generally not directly involved in obtaining or worrying about this paperwork. The complexities of legal compliance are managed professionally within the supply chain from miners to buyers, often bypassing direct interaction with sellers regarding documentation due to practical challenges such as limited literacy among some miners.

The gold buying offices act as intermediaries, streamlining these processes and ensuring that all necessary formalities are addressed without involving the sellers excessively. Therefore, when a purported seller of gold brings up concerns or mentions issues related to documentation—whether it’s about having it or not—it serves as a significant indicator of potential fraud.

The standard business operation in this sector is straightforward: bring gold; receive cash in return. Any deviation from this simplicity, especially the introduction of unnecessary discussions on paperwork by sellers, should raise suspicion. Such behavior typically aims to distract attention from the authenticity and quality of the gold or to engage buyers in fraudulent schemes that involve fake documentation or other illicit activities.

In summary, when dealing with gold transactions:

- Documentation is handled professionally between legitimate buyers and tax authorities.

- Sellers are not expected to be involved in this process due to practical reasons and legal structures.

- Any mention by sellers about needing or lacking documentation outside of standard procedures should be considered a warning sign of potential fraud.

This advice helps individuals recognize scam indicators, ensuring they navigate the gold market with caution and informed decision-making.

Gold Sellers Who Claim Inheritance: 🚩 A Common Indicator of a Gold Scam

Claims regarding the inheritance of vast quantities of gold from renowned figures such as celebrities, military officers, or high-ranking government officials often serve as a red flag for what is commonly known as an advance fee scam. These fraudulent schemes typically lure unsuspecting individuals with promises of immense wealth in exchange for a small upfront payment to facilitate the transfer process. The adjectives “fraudulent” and “deceptive” aptly describe these practices, highlighting their dishonest nature. Such scammers employ persuasive language filled with adverbs like “immediately,” “urgently,” and “swiftly” to create a sense of urgency, pressuring victims into acting without due diligence.

The modus operandi involves convincing targets that they are the sole beneficiaries of an unexpected inheritance but must first pay various fees for legal processing, taxes, or authentication. These payments are often requested through untraceable means such as wire transfers or cryptocurrencies to shield the perpetrators from detection. The use of adjectives like “unscrupulous” and “cunning” aptly characterizes these scammers who exploit human emotions and greed.

Despite being a common scam with numerous reports across various jurisdictions, individuals continue to fall prey due to their desire for easy riches. It is crucial for the public to be vigilant against such claims, employing adjectives like “skeptical” and “cautious.” Legitimate inheritance processes do not typically involve solicitation of fees from potential beneficiaries, especially via unsolicited communications. Therefore, individuals are advised to verify all information through official channels before engaging with any purported gold sellers or inheritance agents.

In conclusion, claims of inheriting gold from celebrities or high-profile figures should be met with a healthy dose of skepticism and an understanding that they frequently serve as the cornerstone for a classic advance fee scam. Being informed and cautious is paramount in safeguarding oneself against these deceptive practices that prey on human gullibility.

Identifying Gold Scams: 🚩 The Girlfriend’s Gold Story Trap Explained

Online dating scams often involve deceitful tactics designed to ensnare unsuspecting individuals with promises that are as alluring as they are elusive. These fraudsters typically employ pictures of online porn stars or individuals from distant lands, sometimes falsely claiming to be Americans stranded in places like Ghana or Nigeria. The narratives woven by these scammers can be incredibly persuasive, often incorporating heartrending stories about sudden inheritances of vast gold reserves or untold wealth. They promise their victims not just companionship but also the allure of GOLD – a tangible symbol of prosperity and fortune.

The modus operandi is straightforward yet devastatingly effective: they bait their targets with tales that tug at emotional heartstrings, playing on desires for love and financial gain simultaneously. The scam unfolds as the fraudster claims to need assistance to unlock this supposed inheritance, requesting advance fees under various pretenses – legal aid, transfer costs, or even bribes. Victims are led down a path of hope and anticipation, dreaming of both securing a loving relationship AND striking it rich with GOLD.

However, what begins as a hopeful journey towards love and wealth ends in heartache and financial ruin for the victim. The scam’s core mechanism relies on exploiting trust while dangling promises that are too good to be true – promises of gold mines waiting to be claimed alongside the affection of an exotic or distant partner. In reality, these deceitful individuals have no intention of delivering either love or wealth; their sole aim is to extract as much money as possible from their victims.

In essence, online dating scams involving fake pictures and false claims about gold inheritances are classic examples of advance fee frauds. They exploit the universal desires for connection and prosperity, leaving those ensnared with empty bank accounts and shattered dreams – a stark reminder that not everything glittering on the internet is gold.

How the Term “Cash and Carry” Can Signal a Scam 🚩

The phrase “Cash and Carry” suggests a straightforward purchase of gold where one pays in cash at the point of sale and then physically transports the purchased gold to their country. However, this concept does not translate into practical reality for individuals looking to buy gold in East African countries due to stringent regulations and legal requirements.

Here’s why it serves as a scam indicator:

Regulations on Gold Trade: In many East African nations, buying gold requires specific licenses or permits. Foreigners are often prohibited from purchasing gold outright without fulfilling these conditions.

Legal Requirements for Export: To legally export gold out of countries like Tanzania and Uganda, one must adhere to strict protocols which include assaying the metal to confirm its purity, obtaining Ministry of Minerals approval in Tanzania, refining in Uganda before exportation, paying necessary royalties and securing an export license each time.

No “Gold Dust” or “Fake Nuggets”: The notion of purchasing gold dust or unverified nuggets is misleading because all gold must be melted down and assayed to confirm its purity before being certified as legitimate for sale, typically in the form of bars.

Transportation Restrictions: In countries like Uganda, there are explicit restrictions on physically “carrying away” purchased gold; it must be transported via courier or air cargo services. This makes the idea of a simple cash and carry transaction unfeasible.

Misrepresentation by Sellers: When sellers propose a ‘cash and carry’ method, they may be intentionally ignoring these critical regulatory hurdles to lure potential buyers into what is essentially an illegal operation.

In summary, when you encounter someone offering gold through a “cash and carry” scheme in East Africa, it’s highly likely that this seller either does not understand or deliberately ignores the legal complexities involved in purchasing and exporting gold from these regions. This ignorance or evasion of regulations should raise red flags about their credibility, suggesting that such offers are indicative of potential scams.

Indications of a Gold Scam: 🚩 Beware When Gold Sellers Ask Which Refinery to Bring the Gold To

When an individual purporting to sell gold begins probing about “which refinery you use,” this behavior serves as a red flag indicative of potential fraud. The question is part of a strategy aimed at identifying those who might not have established business presences, often referred to as ‘wannabe’ buyers.

In regions like East Africa, legitimate purchasers in the gold trade typically operate through physical offices rather than from temporary locations such as hotels or other refineries. This specificity underscores the importance of having a stable and identifiable place of business.

The reason behind asking “which refinery do you use” is that many refineries and government assaying offices across East Africa may harbor corrupt employees who can fabricate assay reports to certify gold authenticity, even when it isn’t real. Such inquiries allow scammers to gauge how they might manipulate the process for their fraudulent schemes.

If a buyer mentions using a reputable and licensed gold office, the seller will likely express fear or concoct reasons against dealing through such established entities. This reluctance stems from their preference for conducting scams in seemingly legitimate but actually corrupt refinery environments.

It’s crucial to understand that genuine gold buyers have no interest in engaging with scammers. Despite this, some licit premises have unfortunately started cooperating with fraudulent actors due to various pressures or incentives.

Thus, when a supposed seller asks about your refining facility as part of the transaction process, it should be viewed as a significant warning sign of potential fraud. To protect yourself:

- Establish and operate from your own office.

- Instruct others to visit you there for any financial transactions.

Remember that for every genuine refinery, there exists an imposter—a counterfeit operation designed to exploit those who are not vigilant. It’s essential to be aware of these setups tailored specifically for unsuspecting buyers.

By being informed about such tactics and maintaining a clear business presence, one can significantly reduce the risk of falling victim to gold-selling scams in East Africa or elsewhere. Always prioritize transparency and thorough due diligence when engaging with potential sellers.

Recognizing Gold Scams: 🚩 The Dangers of Asking for Documents and Nationality

When a “seller” requests personal information such as your documentation and nationality, this often signals an attempt to profile you. This action can also hint at their intent to misuse your details for fraudulent activities like identity theft. It’s important to note that while legitimate businesses may require some form of verification in certain contexts, handling sensitive documents remotely or over the internet with unfamiliar parties is risky.

A safer approach involves verifying the seller’s authenticity firsthand by visiting their physical location. Only then should you consider exchanging necessary documents, and even so, this exchange should occur on-site and face-to-face to avoid potential misuse of your information in fraudulent schemes.

Receiving requests for personal identification from distant or unknown individuals over the internet is a significant red flag indicating a possible scam. Always exercise caution and prioritize protecting your personal data.

Indications of a Gold Scam: 🚩 Beware When Gold Sellers Don’t Ask Your Price

A legitimate gold dealer shows keen interest in the selling price of their gold. This reflects their genuine intention to secure an optimal transaction value for their merchandise.

Conversely, when a purported seller does not inquire about the buying price from potential buyers, this should serve as a red flag—an indicator that they may be involved in fraudulent activity.

Similarly, if a seller initiates discussions with unrealistically low prices without being prompted by the buyer’s interest level or offers, this too is suspicious behavior and could indicate a scam.

In regions like East Africa where poverty is prevalent, individuals selling gold are typically motivated by maximizing their earnings. They would rather travel long distances to secure better deals than settle for cheap prices.

The market dynamics in areas with many buyers create competition among sellers. When a seller travels to the city, it signifies that they are aiming for favorable terms and will not stay passive about pricing negotiations since price is paramount in gold trading transactions.

A genuine gold seller always seeks information on what potential buyers are willing to pay for their goods.

On the other hand, scammers operate with deceitful tactics. They may offer enticingly low prices as bait to attract unsuspecting buyers into their fraudulent schemes, much like a spider luring its prey into a web. Such deceptive practices aim to exploit individuals who might not be fully aware of the true value of gold or who are overly eager for what seems like an excellent deal.

Indications of a Gold Scam: 🚩 Beware of Sellers Showing Pictures of Other Buyers Holding Gold

To create a facade of legitimacy, fraudulent gold sellers entice unsuspecting individuals they label as desperate gold buyers. These targets often lack financial resources but harbor ambitions to act as intermediaries in the transaction. The schemers request copies of their passports and coerce them into posing with counterfeit gold items in photos or videos. This faux gold is typically crafted from brass or silver-copper alloys, skillfully manipulated to resemble genuine yellow metal.

In these deceitful portrayals, the “sellers” may share images or footage with other potential victims to bolster credibility and foster misplaced trust.

This practice serves as a significant red flag signaling fraudulent activity:

Faux Seller Authenticity: The fabrication of seller identities undermines any semblance of genuine business operations.

Prey Selection: Targeting individuals with financial constraints who are eager for profit is a manipulative tactic to exploit vulnerability.

Passport Copy Requests: Demanding personal identification documents raises privacy and security concerns, and it’s an unnecessary step in legitimate transactions.

Counterfeit Gold Display: The use of brass or silver-copper alloys as stand-ins for gold reveals the fraudsters' lack of integrity and willingness to deceive through visual mimicry.

Visual Persuasion Tactics: Sharing deceptive media is a ploy to convince others without providing tangible proof or secure transaction methods.

Important Advisory: Engaging in activities where you are asked to pose with fake items, especially under the guise of gold transactions, should be categorically avoided. Such requests compromise your privacy and security while entangling you further into what could develop into a scam scenario.

In summary, when potential sellers employ tactics such as creating false identities, exploiting vulnerable individuals' financial desperation for their gain, and using deceptive visual aids to substitute real items with fakes – these are clear indicators of fraudulent intent. Always exercise caution and skepticism in online transactions that seem too good to be true or involve unusual requests like posing with precious metals before purchase.

How Photos of Gold with Your Name Can Signal a Scam

Scam Alert: 🚩 Red Flags When Dealing with “Gold” Sellers

Beware when a seller provides images purportedly showing “gold,” which turns out to be brass or silver-copper alloys, personalized with your name and the current date marked on a newspaper. This tactic is nothing more than an attempt to lure unsuspecting buyers into their fraudulent scheme.

Key Points:

Fake Proofing: The inclusion of your personal details along with a recent newspaper date does not validate the authenticity of the gold; it’s merely a deceptive ploy.

Genuine Gold Transactions: Legitimate gold sellers do not engage in such superficial proofing via images or videos, nor do they initiate contact through the internet. They operate within established channels and know exactly where their product is headed.

Indicators of Fraud:

- Receiving personalized pictures with claims of “proof” that are easily fabricated.

By understanding these deceptive practices, you can protect yourself from falling victim to such scams. Always remember, genuine gold transactions do not involve the unnecessary theatrics seen in these fraudulent attempts. Stay vigilant and informed!

Indications of a Gold Scam: 🚩 Beware When You Haven’t Determined Your Own Price

When venturing into purchasing gold without a grasp on market dynamics and competitive pricing strategies, one becomes particularly susceptible to falling victim to fraudulent practices. The East African region, teeming with established physical buyers who are well-versed in setting fair prices based on current market standards, underscores the necessity of understanding this complex landscape.

To approach the transaction naively—admitting ignorance about appropriate payment while relying solely on a seller’s proposal—is akin to waving a red flag for scammers. It signals an openness to accept significantly lower-than-market-value offers, essentially inviting deceitful practices.

Contrastingly, seasoned gold buyers engage in rigorous negotiations from positions of informed strength within the confines of their established offices. They possess the knowledge and resources necessary to assert fair prices confidently.

For an individual buyer without a pre-determined price point or awareness of what other legitimate buyers are willing to pay, entering into such transactions with only a desire for ‘cheap’ gold is indicative of inexperience and vulnerability. This lackadaisical approach towards market education and responsibility serves as the perfect breeding ground for fraudulent sellers.

In essence, failing to educate oneself about the gold market before engaging in transactions is akin to stepping blindly into a minefield of scams. It’s crucial to recognize that knowledge empowers buyers with the ability to make informed decisions, thus safeguarding against fraud. This awareness and proactive engagement are fundamental steps towards avoiding exploitation within the gold-buying arena.

How Offers of Large Quantities Can Signal a Scam

Scam Indicator Alert: Extreme Caution with Gold Offers from East & West Africa

The proposition of acquiring a substantial volume of gold from nations such as Uganda, Kenya, Tanzania in East Africa or Ghana, Mali, Nigeria in West Africa should immediately raise red flags. This pattern is emblematic of fraudulent schemes.

Ponder this: Why would legitimate entities amass vast quantities of gold without established avenues for its sale? The fundamental premise behind investing in gold mining operations is the certainty and ease of selling the extracted gold.

A genuine miner or trader operates under informed business acumen, fully aware of markets and buyers before committing to production or purchase.

Key Indicators:

Lack of Transparency: Genuine transactions are transparent; sellers know their market, buyers, and processes.

Unsolicited Offers: Be wary when gold is offered without your active pursuit; such offers often target unsuspecting individuals outside the industry.

Broker Chain Involvement: The involvement of multiple brokers each promising access to this ‘exclusive’ deal should signal danger. Such chains are notorious for spreading misinformation and scam tactics.

Gullibility Exploitation: These schemes play on the desire for quick, large profits from individuals who may not be well-versed in gold trading or have little business experience.

Absence of Legitimacy: Genuine transactions involve known entities with verifiable histories; deals shrouded in mystery are likely fraudulent.

Conclusion:

Always exercise due diligence when presented with such opportunities, and remember that knowledge is your best defense against falling victim to scams. Knowing the market, understanding normal business practices, and being skeptical of too-good-to-be-true offers can help you steer clear of potential pitfalls.

Indications of a Gold Scam: 🚩 Beware When Gold Sellers Lack a Physical Office

When seeking to purchase gold and inquiring about viewing it firsthand, be wary if the seller suggests meeting at an unconventional location such as “another refinery” or a “hotel.” If your request for their legitimate business premises meets with evasion or claims of being mislocated—or worse, nonexistent—this should serve as a red flag. A genuine dealer would have a clear physical office presence.

This behavior indicates that the operation may be fraudulent. Scammers often avoid establishing permanent locations to evade detection and accountability. As an informed buyer, always insist on visiting the seller’s official business premises before engaging in any transactions.

Conversely, if you are looking to sell gold or purchase it and encounter a purported dealer lacking a physical office or showroom, proceed with extreme caution. This absence is typically indicative of unscrupulous activity. It’s imperative for your financial safety to steer clear and seek reputable dealers who operate transparently from established locations.

In summary, the lack of a tangible business location serves as an unmistakable indicator that you may be dealing with scammers intent on deception and fraud. Always prioritize transactions with sellers or buyers who have verifiable, physical business addresses.

How an Empty Office Can Signal a Scam

When “sellers” claim to have a physical office but upon visiting:

- The desk appears barren with no paperwork or files.

- No employees are present.

- Essential amenities like water dispensers for hot weather and coffee are conspicuously absent.

- There’s an absence of any food-related smells, suggesting lack of actual business operations.

- Basic necessities in the restroom such as toilet paper are missing.

And all you see is a solitary license hanging on the wall without any sign of legitimate activity or operational essence.

This constellation of factors serves as a glaring red flag—a clear indicator that something isn’t right. It’s time to trust your instincts and swiftly exit from what unmistakably appears to be a scam.

Indications of a Gold Scam: 🚩 Beware When Gold Nuggets Look Uniform and Button-Like

Oh joy! The generous souls over at ScamCo Inc. are practically giving away boxes upon BOXES filled to the brim—literally kilos, even tonnes—of what they cheekily refer to as “gold nuggets.” Because nothing screams authenticity like a bulk-buy discount on precious metals, right?

But alas! Your keen eye for detail must be on vacation because you somehow missed that crucial step of self-education. The monumental effort it would take to Internet image search “genuine gold nugget” escaped your notice. Instead, here you are, diving headfirst into a sea of what I can only assume is brass or silver-copper alloy—masquerading as the real deal.

Let me break this down for you in layman’s terms: Button-like bits of metal? Not. Gold. Nuggets. Stupidity isn’t usually listed under “qualities to look for in an investment,” but here we are!

So, run away from these shiny trinkets faster than a cat from a bath! Because unless your idea of high-value investing includes brass knick-knacks, you’re about to get played like the world’s worst fiddle.

Indications of a Gold Scam: 🚩 Beware of Gold “Powder” Offerings

When considering the purchase of “gold powder,” be wary if:

The seller claims the product is pure gold but upon testing with a simple solution like nitric acid, it reacts by turning green and producing foam, suggesting that what you’re getting is brass disguised as gold—a classic red flag for fraud.

It’s asserted that the gold originates from mining operations where supposedly large quantities of dust accumulate; in reality, legitimate miners swiftly sell their genuine gold dust because of its high value.

You are offered significant amounts of “gold dust” at a suspiciously low price—this is often an indicator that the product being sold is not authentic but rather counterfeit or brass masquerading as precious metal.

In essence, be cautious when encountering deals on bulk gold powder which react positively to nitric acid tests and those claiming unusual abundance from mining sources. These characteristics are tell-tale signs of a scam in the gold market.

How Excessive Shine Can Signal a Scam

An excessive luster on purported “gold” items often serves as a red flag for scams. Sellers may peddle what appear to be solid gold bars when in reality they are cleverly disguised brass coated with a thin layer of gold. The deceptive sheen might mimic the gleam associated with pure gold, but upon closer inspection, one can discern the telltale signs of brass—its weight feels lighter than genuine gold and its texture reveals its true nature under even casual handling. This discrepancy between appearance and reality underscores the importance of skepticism when encountering such ostentatiously shiny “gold” offerings. The key to recognizing these scams lies in understanding that authentic gold does not typically exhibit an overly exaggerated shine; instead, it displays a rich but more natural luster that reflects its purity without needing to dazzle with excess brilliance. Thus, buyers are advised to approach such dazzlingly “too good to be true” deals with caution and rely on trusted methods of authentication before making any purchases.

Indications of a Gold Scam: 🚩 Beware When the Gold Surface Doesn’t Match Real Melted Gold Texture

Melting gold results in a smooth and glossy surface texture due to its high malleability and resistance to oxidation. The molten metal flows freely without leaving many impurities or irregularities on the surface, leading to an almost mirror-like finish when cooled.

Conversely, when brass is melted, it typically exhibits a rougher surface texture compared to gold. Brass is an alloy primarily composed of copper and zinc, which can create a grainy appearance upon melting due to varying rates of melting between its components. Additionally, the presence of impurities or bubbles trapped during the melting process may contribute to an uneven surface finish on melted brass.

In conclusion, understanding the natural characteristics of melted metals such as gold and brass can help consumers identify potential scams in metal sales. Unnaturally smooth claims about molten metal products might indicate a lack of authenticity or transparency from sellers. Buyers should exercise caution and seek out reputable sources when purchasing precious metals to avoid falling victim to fraudulent practices.

Recognizing Gold Scams: 🚩 The Dangers of Oversized “Gold” Bars

When handling what purports to be a 250-gram gold bar, one may notice that its size is disproportionately large for its weight. Such a bar would occupy space akin to that of an oversized yogurt cup, which raises immediate red flags due to the inherent properties of genuine gold. The density of pure gold typically ensures that it possesses substantial heft in relation to volume; thus, a piece claiming 250 grams but resembling more a common dairy container is almost certainly indicative of fraudulence. This discrepancy between expected weight and observed bulk serves as an unmistakable scam indicator. Legitimate gold bars of this mass would feel dense and heavy for their size, not hollow or deceptively light. Therefore, when encountering such suspiciously spacious “gold”‘, one should proceed with caution; it’s likely that the seller is attempting to deceive potential buyers into purchasing counterfeit or less valuable materials masquerading as precious metal.

Recognizing Gold Scams: 🚩 The Dangers of Bad-Tasting “Gold”

Scam Alert:

Be on guard when someone tries to sell you “gold” that tastes off. Real gold doesn’t have a flavor and it’s safe for your body – hence its precious status.

If what they’re offering has a bad taste (likely brass), don’t wait, just get away! It’s probably a scam.

Summary:

Genuine gold is tasteless and safe to the human body; anything with an off taste claiming to be gold is likely fake—run from such scams!

Indications of a Gold Scam: 🚩 Beware When Generals Are Involved

The involvement of military generals often signals potential scams rather than legitimate business ventures. Historically, when individuals with high-ranking titles such as “general” prominently feature themselves or their credentials in investment opportunities related to natural resources like gold mining or trading companies, it raises red flags for investors and analysts alike.

Military generals are not generally allowed to trade in gold unless they possess a proper license. If such individuals engage in trading without one, you might wonder why these high-ranking officers would risk exposure when there are others who can conduct transactions on their behalf.

Recognizing Gold Scams: 🚩 The Dangers of Name-Dropping in Gold Transactions

When someone trying to sell something mentions famous names like presidents or generals without any real connection and claims it involves dealings with gold in East Africa—especially if they also bring up police, tax offices, celebrities or even deceased government officials—it’s a big red flag. This tactic is meant to trick you into believing there’s legitimacy behind the deal because of these high-profile mentions. However, this name-dropping strategy is often used by scammers to create a false sense of security and credibility where none truly exists.

In simpler terms: If someone talks about famous people or important figures in connection with gold sales from East Africa to make their story sound believable but offers no real proof, it’s probably not true. This tactic is common among scammers trying to cheat you out of your money by making things sound more official and trustworthy than they really are. Always be cautious when such names are casually dropped into a deal without any genuine context or evidence.

Indications of a Gold Scam: 🚩 Beware When Diplomats, Politicians, and the United Nations Are Involved

Imagine this scenario: Someone contacts you, saying they’re a VIP from the world of politics or even an official with the United Nations itself. They tell you about an amazing gold deal happening in East Africa and try to convince you it’s too good to miss. But here’s the catch—when people start throwing around names like diplomats and politicians for something as ordinary as selling gold, especially targeting regions like East Africa, it’s usually a scam. Such grandiose claims are designed to dazzle your senses and lower your guard, making you more susceptible to falling for their deceitful schemes. Remember, when offers sound too good to be true and involve big names in unlikely scenarios—stay alert; it could very well be a trick meant to take advantage of unsuspecting individuals.

Key Points:

- High-profile Names: When sellers use the names of diplomats or politicians, especially from international bodies like the UN.

- Region Specificity: Targeting deals specifically in regions such as East Africa.

- Indicators of Scam: These are red flags that should alert you to potential fraud.

In essence, be wary if someone tries to entice you with tales of grandeur and connections involving high-profile figures for gold sales, particularly in specific geographic areas. It’s a classic scam tactic meant to lure people into giving away their hard-earned money or personal details under false pretenses.

Deciphering the Red Flags: 🚩 Gold Sellers Mentioning Security Houses

Beware of fake deals claiming you can buy lots of gold cheaply. These scammers say there’s a ton of gold in a security house and all you need to do is pay some money upfront as security or fees. They make it sound like an amazing deal, but really, this is just their trick! After paying the initial fee, they’ll likely ask for more cash for lawyers or other made-up reasons. In reality, there might not even be a real security house with gold—just promises to take your money. This request for money upfront is a huge red flag that it’s all a scam.

The Truth About Export Taxes: 🚩 Identifying Scam Risks in Gold Transactions

When someone tries to sell you gold and says they can’t pay an “export tax,” it could be a warning sign. In truth, there might not even be such a tax at all! Shockingly, these scammers often manage to trick the system by getting official refunds from corrupt officials for fake taxes paid.

These deceitful sellers will make buyers nervous about international transactions by demanding payment upfront before shipping the gold. But here’s the catch: The gold never arrives where it’s supposed to go. This is a classic case of asking for money in advance, also known as an “advance fee scam.”

It’s crucial advice not to engage with such individuals or businesses. Always be cautious and avoid any dealings that seem too good to be true or involve suspicious financial demands before receiving goods.

Summary: Be alert for sellers claiming they can’t pay a non-existent export tax on gold, requesting money upfront without delivering the goods. This is a clear sign of an advance fee scam—stay away!

Indications of a Gold Scam: 🚩 Beware When Gold Sellers Have No Money but Demand Your Payment for Fees

Scam Warning:

Be cautious if a seller claims to have valuable items like gold but faces financial troubles such as lacking money for transportation or accommodation. This scenario is often a red flag and common in places like Uganda, Kenya, and Tanzania. It’s crucial to remember that genuine sellers typically have the means to manage their goods' logistics without significant difficulties.

Simplified Explanation:

If someone says they have gold but can’t afford to move it or stay at a hotel, this might be a trick. This happens often in countries like Uganda, Kenya, and Tanzania. Be careful—real sellers usually don’t face such money problems with their goods.

In essence, if you encounter stories where “sellers” claim possession of valuable items yet simultaneously express financial constraints for basic needs related to the sale (like transport or lodging), consider this a warning sign. This situation is frequently associated with fraudulent attempts in East African countries like Uganda, Kenya, and Tanzania. Always be vigilant against such potential scams by ensuring transactions are secure and verified.

Understanding the Warning Signs: 🚩 Unsolicited Gold Offers via Email

In your inbox, you might receive an enticing proposal: someone offers to sell you gold directly from Africa through emails or messages on LinkedIn. Be cautious! This could be a red flag for a scam.

Here’s why it stands out as suspicious:

Firstly, gold is highly marketable worldwide; thus, legitimate sellers would have no trouble finding buyers locally or globally without needing to approach random individuals abroad.

Secondly, the need to contact you from afar suggests they are looking for someone who might be less familiar with the intricacies of gold transactions and therefore more vulnerable to their deceitful tactics.

In simpler terms: If it sounds too good to be true and involves mysterious sellers offering valuable items like gold from distant lands without a solid reason why they can’t find buyers closer to home, it’s likely not legitimate. Trust your instincts—if something feels off, it probably is.

Indications of a Gold Scam: 🚩 Beware When a Full Corporate Offer (FCO) Is Involved

When someone talks about a “Full Corporate Offer,” beware—it’s not real. This idea is made up by tricksters online who want to cheat you. Even though many honest people might think it’s true, it isn’t part of any actual business deals.

These scammers often don’t give their real address or contact details and pretend that the offer is complete (that’s what “Full” means). They also make up fake stories about buying or selling lots of expensive things like gold.

If you see these signs—no proper info, big promises with no proof—it’s a red flag telling you it could be a scam.

Remember: Always check if an opportunity seems too good to be true and look for real contact information before getting involved.

Indications of a Gold Scam: 🚩 Beware When You Have No Experience in Gold Trading

Scam Alert: Gold Purchases from East Africa

Buying gold without prior experience and choosing to do so from sellers located specifically in East Africa should raise red flags as a strong indicator of potential fraud. This situation screams “scam” due to several reasons:

Lack of Experience: Engaging in high-value purchases like gold without any past dealings or understanding can make you an easy target for scammers.

Specific Region Mentioned (East Africa): The mention of East Africa as the location is notable because this area has been associated with various scams, particularly involving precious metals and commodities.

No Seller Reputation: If there’s no track record or reputation for the seller you’re dealing with, it increases the likelihood that they are not legitimate.

In simpler terms, if you’re new to buying gold and decide to do so from sellers in East Africa without checking their credibility first, chances are very high that this transaction is a scam. Beware of such situations as they almost always lead to financial loss or disappointment. Always verify the seller’s reputation before proceeding with any significant purchase, especially something as valuable and easily counterfeited as gold.

Key Points:

Inexperience + Target Region = High Risk: A combination of inexperience in buying gold and choosing East Africa for the transaction significantly increases scam risk.

No Seller Verification: Not researching or verifying the seller’s background is a clear sign that you’re walking into a potential trap.

Be cautious and informed before engaging in any high-value transactions, especially when they involve significant sums of money or valuable items like gold.

Understanding the Warning Signs: 🚩 Lack of Business Administration Skills

When someone comes from abroad to buy gold in an East African country but doesn’t have smart business managers working for them, it’s a big red flag. This situation shows that the buyer could easily fall into a trap – it’s like setting up a target for scammers. Without having skilled professionals who understand how to manage businesses, this lack alone signals that the buyer might be involved in some kind of trickery.

Before jumping into any deal, do your research and ensure you have capable people working with you who can navigate through such risky situations. Protect yourself by being well-prepared and informed.

Understanding the Warning Signs: 🚩 Newcomers Seeking Quick Profits from Gold

When newcomers arrive in East Africa with dreams of swiftly making a fortune through gold dealings, they should be cautious. It’s crucial to recognize certain red flags that may indicate a scam is lurking around the corner. Here are some simple indicators:

Too Good to Be True Offers: If someone promises you quick and easy money from gold without any risk or effort, it’s likely too good to be true.

Urgency and Pressure: Scammers often create a sense of urgency or pressure. They might tell you that this golden opportunity won’t last long, pushing you to make hasty decisions.

Vague Details: Be wary if the details about the gold deal are unclear or scarce. Legitimate business dealings are usually transparent and well-explained.

Request for Money Upfront: A common scam tactic is asking for money upfront with promises of big returns later on. Remember, genuine investments typically don’t require you to pay first without a solid guarantee.

In summary, if you’re new to East Africa and someone offers you quick profits from gold deals that seem too good to be true, involve high pressure tactics, lack clarity in details, or ask for money upfront – these are strong indicators of potential scams. It’s always wise to proceed with caution and conduct thorough research before engaging in any financial dealings.

Stay vigilant and protect yourself against fraudulent schemes by trusting your instincts and seeking advice from trusted sources when faced with such offers.

Indications of a Gold Scam: 🚩 Beware When You Don’t Have Enough Money to Buy Even One Gram of Gold

Be cautious when you hear about people wanting to buy gold but claiming they don’t have the cash. This is a red flag—it’s like saying “I want ice cream, but I have no money.” It doesn’t make sense! When someone tells such tales without having the means to follow through, it’s a clear sign of potential fraud.

Here’s why:

Fibbing about Funds: If they say they’re eager to buy gold but lack the funds, it’s like setting up a trap. They’re spinning stories that sound too good—or in this case, too unbelievable—to be true.

The Scam Setup: These individuals are often targeted by scammers themselves because their eagerness and apparent wealth make them look like easy marks to trick others into handing over money.

In simple terms: If someone talks about wanting gold but has no way to pay for it, watch out! It’s a big signal that something fishy is going on. They might be trying to lure you in with promises of deals too good to be true, just so they can take your money and run.

Stay alert and remember: If their story doesn’t add up, walk away before you get caught in the scam!

Understanding the Warning Signs: 🚩 Discrepancies Between Phone Numbers and Seller Names

Phone registrations across East Africa and various other nations typically involve listing them under company or individual names. It is conceivable for a staff member to have their phone number associated with another employee within an organization.

However, if your investigation reveals that all the contact numbers linked to a seller’s team are listed under third-party names and these individuals prove unattainable as per your communication needs, this could be indicative of fraudulent activity—specifically pointing towards gold scam schemes.

Understanding the Warning Signs: 🚩 Discrepancies Across Multiple Contact Numbers

When you come across someone who introduces themselves along with a bunch of other people like friends, brokers, and even more introducers alongside receptionists, bankers, lawyers - it’s a red flag. If your digging shows that all these contacts have phone numbers under different names and none of them get back to you when you try to reach out for info or help with something important – this is big warning sign. This situation screams scam, especially if it smells like one of those gold scam deals where they promise riches but leave you empty-handed.

In simpler terms: If a seller brings along lots of people and all their contact details are fake, and nobody answers your calls or messages, watch out! It’s likely a trick to steal money from you. This is how scammers try to lure you into believing in false gold deals that will end up being worthless.

Indications of a Gold Scam: 🚩 Beware When Beautiful Women Are Involved as Brokers